Daily Comment – Dollar stands tall after robust jobs report

- Strong US data dent chances of a 50bps Fed rate cut

- Plethora of Fed speakers on the wires today

- Dollar enjoys strong gains, stocks rally unexpectedly

- Oil pushes higher as gold’s retreat continues

US jobs report surprises to the upside, doves are displeased

Another exciting week commences as market participants are still digesting the unexpectedly strong US labour market data. The plethora of upside surprises has crushed the chances of another 50bps rate cut at the November 7 meeting, with even the doves acknowledging the fact that the US economy is confidently growing.

The plethora of upside surprises has crashed the chances of another 50bps rate cut at the November 7 meeting

We are likely to hear more on this issue this week, as more than 10 Fed members will be on wires, starting with Kashkari, Bostic, Musalem and Bowman today. Apart from the doves, who will try to manage expectations after the strong US data, it will be interesting to see how the hawks handle the situation in terms of the need for another rate cut in November. Interestingly, the debate could become even more complicated if Thursday’s September CPI report produces another upside surprise.

Dollar enjoys a strong weekly performance

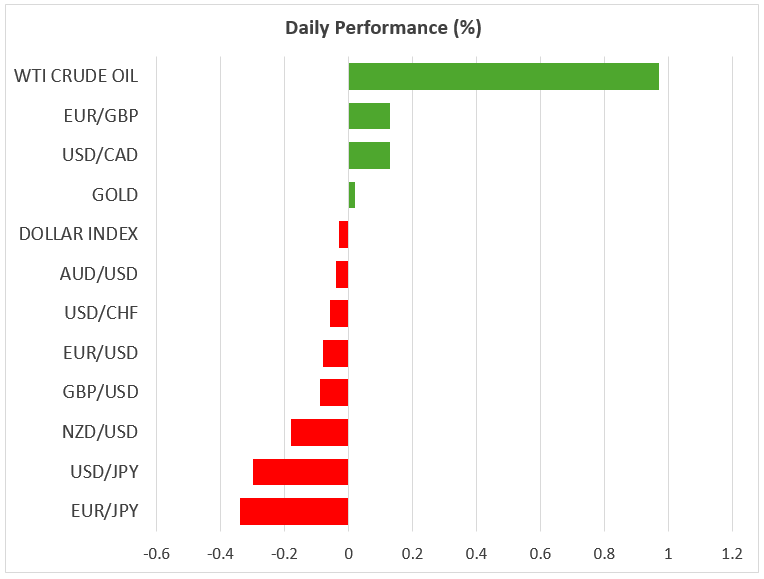

The US dollar was the main beneficiary of last Friday’s data, as the dollar index recorded its strongest weekly performance since September 23, 2022, led by the correction in euro/dollar, which at the time of writing is hovering below the key 1.1000 level, and with dollar/yen climbing abruptly above 148.00.

While the dollar’s reaction was largely expected, the equities’ move produced some question marks. Up to now, the positive market momentum was fueled by the expectations that the Fed will continue to ease its monetary policy stance. However, equities traded higher as if the market shifted gear and was more interested and content with the underlying strength of the US economy.

Equities traded higher as if the market shifted gear and was more content with the underlying strength of the US economy.

This reaction was even more intriguing as the newsflow from the Middle East remained negative. Disappointingly over the weekend, both Israel and Iran’s proxies continued their barrage of attacks, and there is no end in sight. Today marks the one-year anniversary of Hamas’ brutal attack inside Israel. With Israel still pondering its response to last week’s direct Iranian attack, which could even involve targeting Iran's nuclear facilities, negotiations for a temporary ceasefire or a solution have broken down.

Pressure from President Biden for some sort of agreement will continue, as such an outcome might also boost Harris’ electoral chances. Indeed, we have entered that last stretch, as there are fewer than 30 days left before the election, which means the rhetoric from both sides is expected to become more aggressive.

Pressure from President Biden for some sort of agreement will continue, as such an outcome might also boost Harris’ electoral chances

Oil trades higher, gold affected by the stronger dollar

Oil continues its journey higher, temporarily surpassing the $76 level, and thus trading around 13% higher from its early-September lows. This bullish move might have legs, as energy, oil and gas installations are high on the target list for both sides in the Middle East conflict.

On the flip side, the improved risk sentiment and the dollar’s gains have pushed gold below the $2,650 area. This is the fourth consecutive red daily session for gold, but a more protracted correction needs sustainably good US data and a barrage of positive news regarding the Israel-Iran conflict.

相关资产

最新新闻

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。