Daily Comment – Dollar baffled after mixed data and Fedspeak

- Jobless claims contradict the stronger CPI report

- Fed’s Bostic talks about a November Fed pause

- Dollar trades sideways as the market still expects a November cut

- Oil and gold in the green, pound doesn’t enjoy today’s data

CPI and jobless claims jump, but Fed’s Bostic makes the headlines

The US inflation report managed to produce an upside surprise with both the headline and core indicators accelerating by an additional 0.1% on an annual basis compared to the economists’ forecasts. On face value, these figures should have boosted the dollar and caused a weakness in equities. However, the weekly claims figures also printed higher with the initial jobless claims figure jumping to the highest level since May 2023, partly due to Hurricane Helene.

Since the US labour market is at the centre of the Fed’s decision-making process, the post-CPI market movements proved short-lived with the market assuming that the stronger CPI report won’t stop the Fed from cutting rates at the November 7 meeting. Actually, the market-assigned probability for a pause at the next gathering dropped to just 7% after the claims’ release.

The post-CPI market movements proved short-lived with the market assuming that the stronger CPI report won’t stop the Fed from cutting rates

However, Atlanta Fed President Bostic decided to rock the boat by stating that “I am totally comfortable with skipping a meeting if the data suggests that’s appropriate”. This is the second consecutive day of hawkish commentary, as on Wednesday San Francisco President Mary Daly indirectly opened the door for a pause in November by stating that “one or two more rate cuts are likely this year”.

Atlanta Fed President Bostic decided to rock the boat by stating that “I am totally comfortable with skipping a meeting if the data suggests that’s appropriate”

The dollar saw gains on the back of Bostic’s comments, but these quickly vanished as the market is relatively confident that the Fed won’t spoil the party and hence will announce a rate cut in November, even to the tune of 25bps.

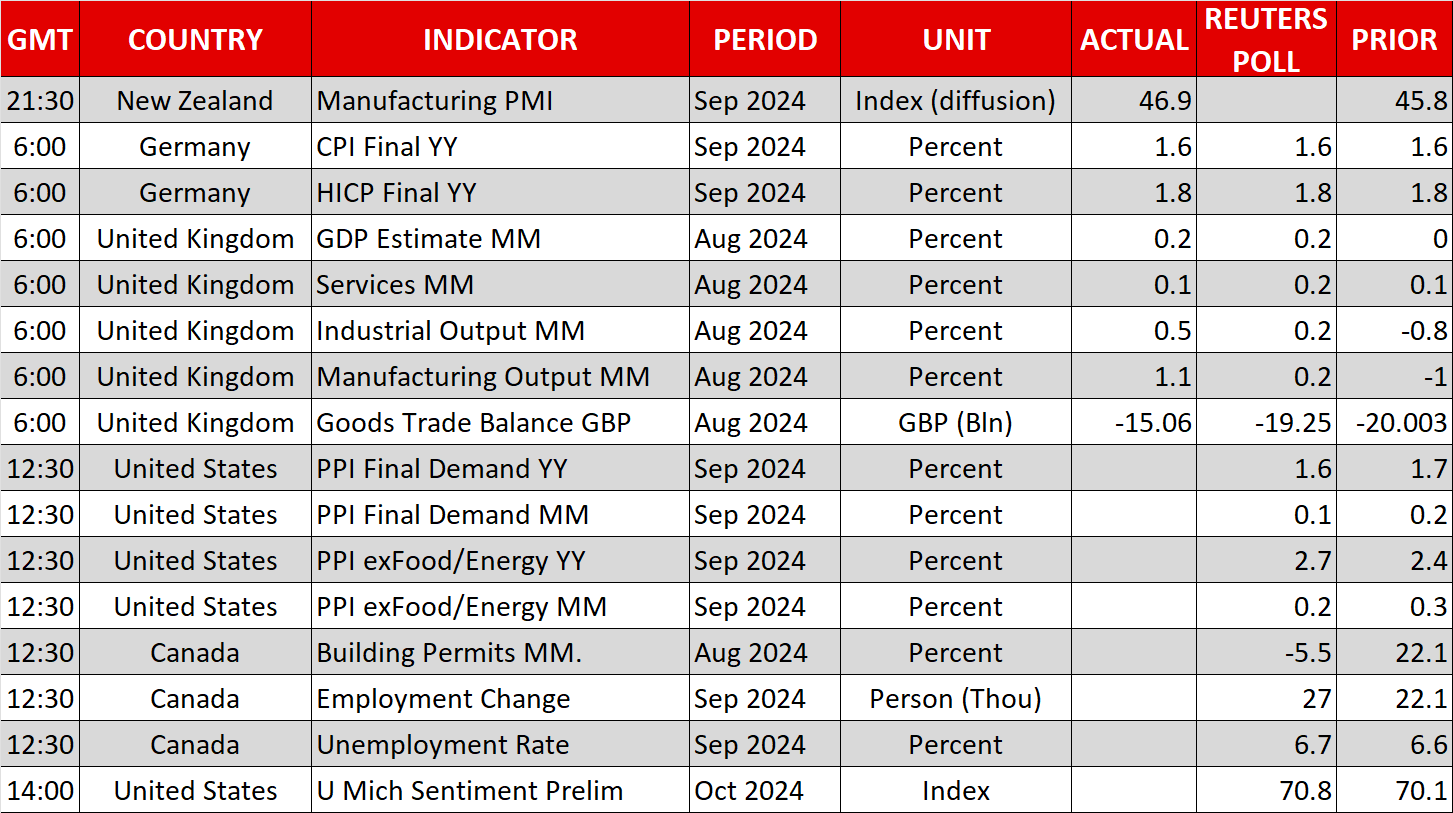

Fed rate cut expectations will remain in the spotlight again today as the September producer price index will be released and at least three Fed speakers will be on the wires, including Board member Bowman. The sole dissenter at the September meeting, and a known hawk, might grasp the opportunity and advocate for a pause in November.

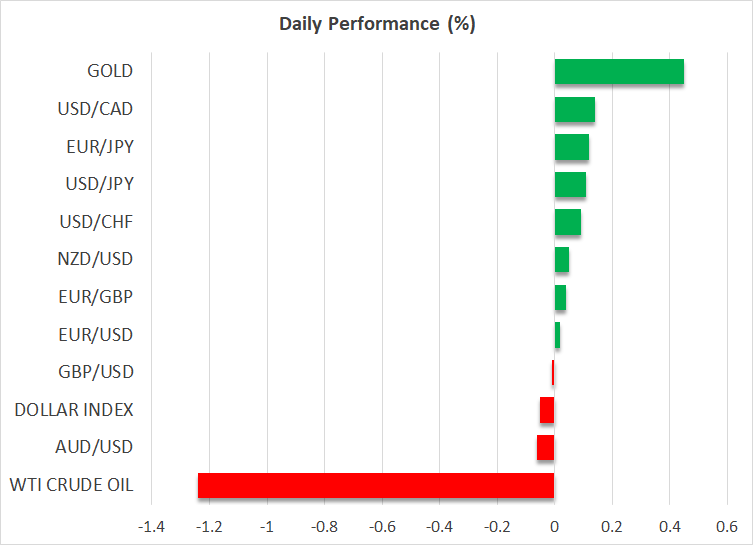

Oil, gold trade higher in parallel

Oil remains in good spirits, hovering around the $75.50 area, as the barrage of attacks from both Israel and Iran’s proxies continue despite renewed efforts, mostly from France and the UK, for some sort of ceasefire. Similarly, gold bounced aggressively higher after unsuccessfully trying to break below the $2,600 area.

China might have played a key role in gold’s performance, but, at the same time, it offers little assistance to the oil rally as the market remains very pessimistic about the impact of the new set of Chinese support measures. The Shanghai composite index closed in the red again today as the new 500bn yuan SFISE facility (security, funds and insurance companies swap facility) has probably been deemed as insufficient.

The market remains very pessimistic about the impact of the new set of Chinese support measures.

Following Tuesday's disastrous press conference, two more have been scheduled for Saturday and Monday, with some analysts joking that the Chinese administration will hold more press conferences than the actual number of measures announced. However, with the private firm IKEA calling for even more Chinese stimulus, the situation on the ground is probably worse than currently perceived.

Pound, euro to take the front seat next week

The countdown to next week’s ECB meeting has commenced with the euro recording its worst monthly performance against the dollar since January 2024. A dovish ECB cut on Thursday could extend the current weakness, particularly against the pound, which will be digesting the busy calendar of employment data to be published on Tuesday and Wednesday's key CPI report. Despite the recent frailty, the pound remains one of the strongest currencies in 2024 with a 2.5% rally against the dollar.

相关资产

最新新闻

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。